What Happened?

Partners Special Capital Limited, an investment firm claiming to offer lucrative financial services, has recently come under fire for its questionable business practices and attempts to suppress damaging reports. Allegations against the company include accusations of misleading clients, dubious financial dealings, and failure to deliver promised returns. Former clients and financial watchdogs have raised concerns about the firm’s lack of transparency in its investment strategies, leading to speculation that it operates in a manner similar to other high-risk ventures that prioritize short-term gain over long-term stability.

Despite mounting criticism, Partners Special Capital Limited has reportedly employed tactics to censor negative reviews and bury unflattering news. This includes legal threats against former clients and publications, aimed at minimizing the impact of damaging stories. The company’s aggressive approach to controlling its public image has only intensified suspicion about its legitimacy, as more clients come forward with complaints about poor service, delayed withdrawals, and unmet financial promises.

In an era where financial transparency is critical, Partners Special Capital Limited’s attempts to hide its shady past raise red flags for potential investors, who are urged to proceed with caution.

Analyzing the Fake Copyright Notice(s)

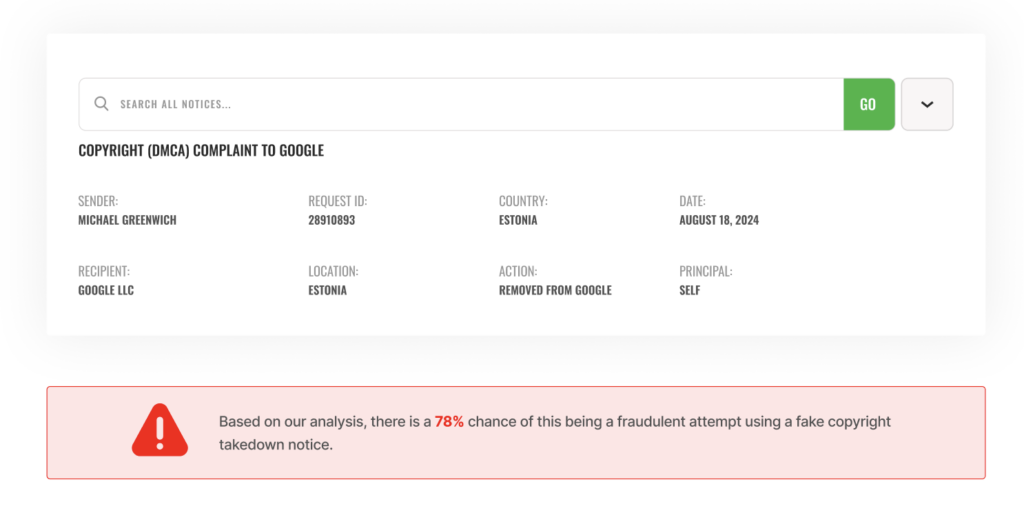

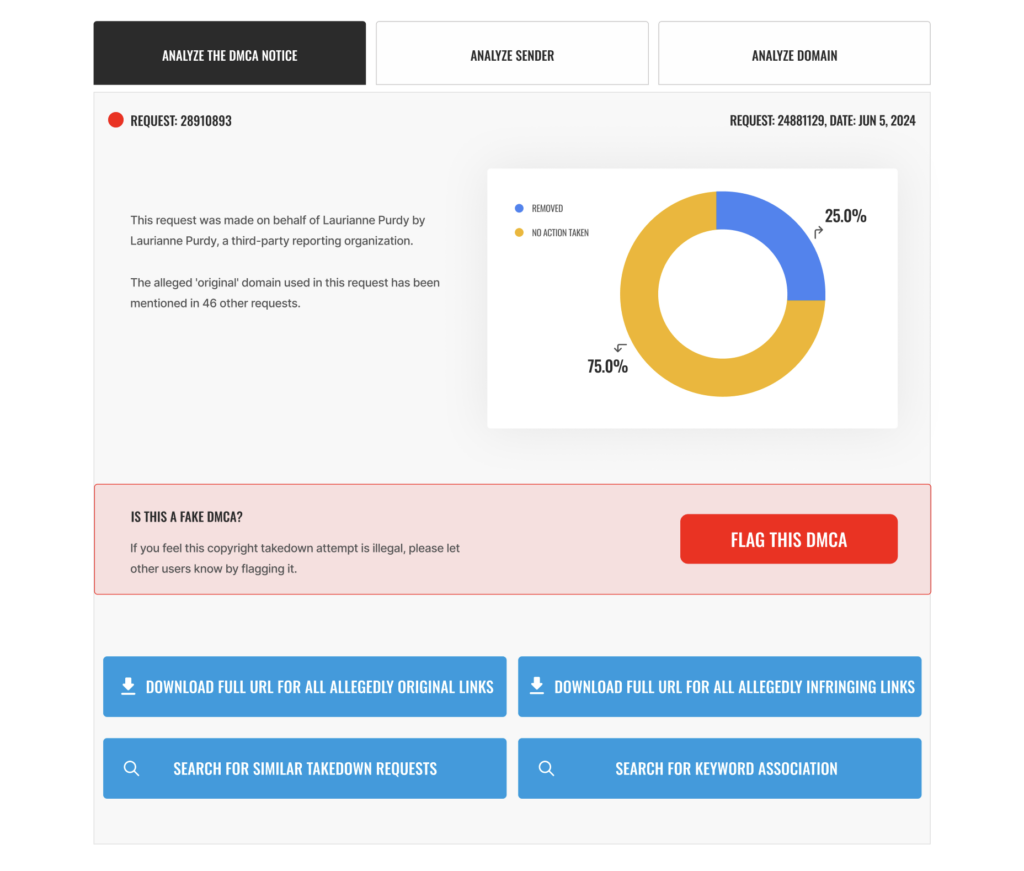

Our team collects and analyses fraudulent copyright takedown requests, legal complaints, and other efforts to remove critical information from the internet. Through our investigative reporting, we examine the prevalence and operation of an organized censorship industry, predominantly funded by criminal entities, oligarchs, and disreputable businesses or individuals. Our findings allow internet users to gain insight into these censorship schemes’ sources, methods, and underlying objectives.

List of Fake Copyright Notices for Partners Special Capital Limited

| Number of Fake DMCA Notice(s) | 1 |

| Lumen Database Notice(s) | https://lumendatabase.org/notices/43984235 |

| Sender(s) | Norine Cohn |

| Date(s) | Aug 21, 2024 |

| Fake Link(s) Used by Scammers | https://telegra.ph/PartnersSpecialCapitalLtdcom-Partners-Special-Capital-Ltd-otzyvy—NE-VERIT-Kak- vyvesti-dengi-08-21-4 |

| Original Link(s) Targeted | https://grazyna30495.blogspot.com/ |

Evidence and Screenshots

How do we investigate fake DMCA notices?

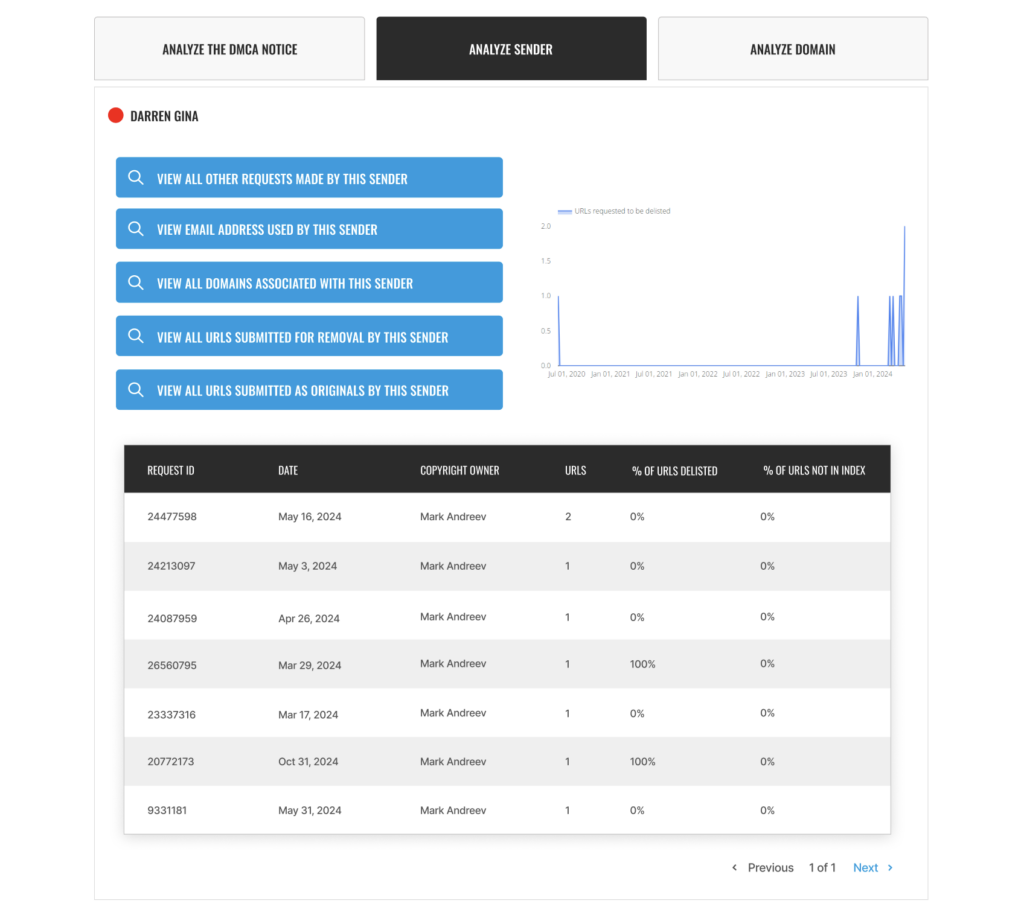

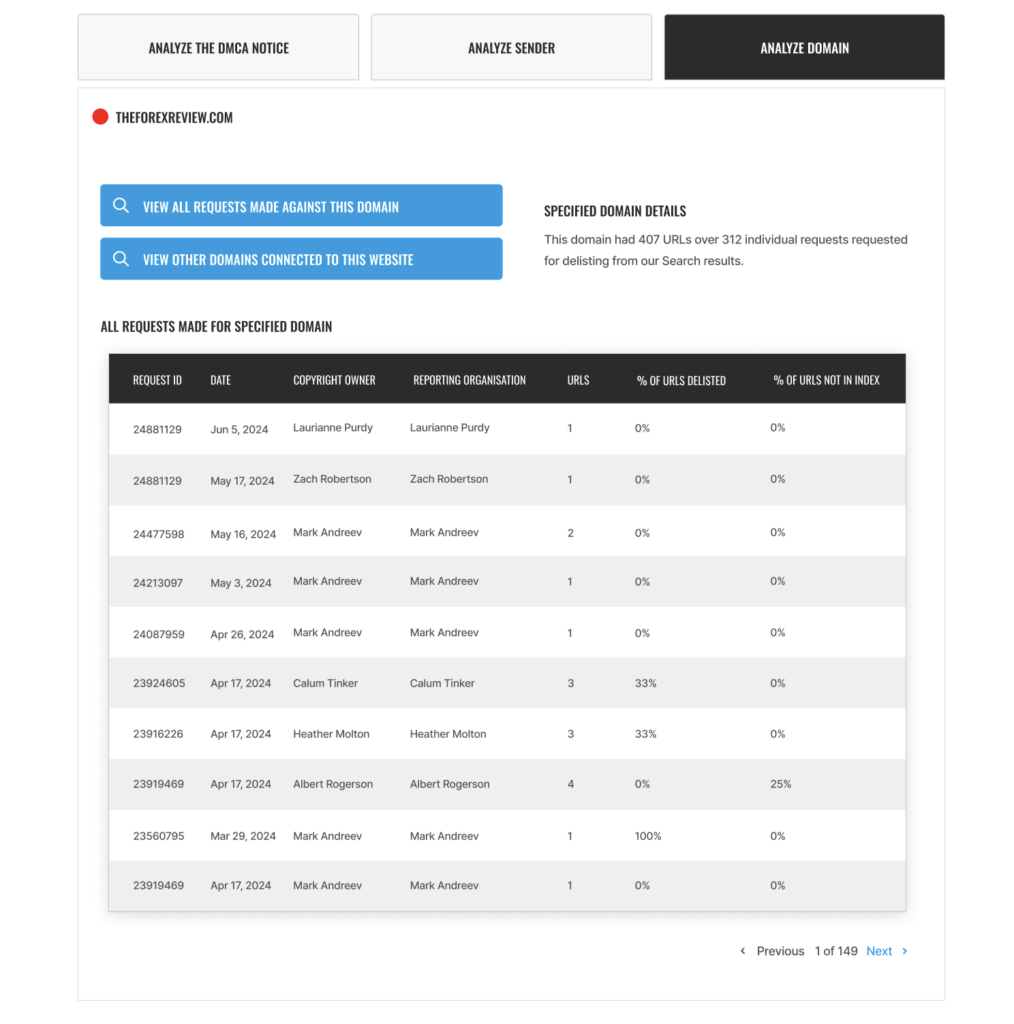

To accomplish this, we utilize the OSINT Tool provided by FakeDMCA.com and the Lumen API for Researchers, courtesy of the Lumen Database.

FakeDMCA.com is the work of an independent team of research students and cybersecurity professionals, developed under Project UnCensor. Their OSINT Tool, designed to uncover and analyze takedown notices, represents a significant step forward in combating these abusive practices. It has become a valuable resource, increasingly relied upon by journalists and law enforcement agencies across the United States.

Lumen, on the other hand, is an independent research initiative dedicated to studying takedown notices and other legal demands related to online content removal. The project, which operates under the Berkman Klein Center for Internet & Society at Harvard University, plays a crucial role in tracking and understanding the broader implications of such requests.

What was Partners Special Capital Limited trying to hide?

Partners Special Capital Limited presents itself as a sophisticated investment firm offering a range of trading opportunities across various financial markets. It claims to operate out of the UK and provides different account types and trading plans, catering to both beginner and experienced traders. However, upon closer inspection, numerous red flags have emerged, casting doubt on the legitimacy of the company’s operations. Complaints from clients, coupled with investigative reports, have revealed a troubling pattern of fraudulent practices, a lack of regulatory oversight, and efforts to suppress damaging information online.

False Identity and Misleading Information

One of the most concerning aspects of Partners Special Capital Limited is its apparent misuse of the identity of a legitimate company. The broker claims to be registered in the UK, using the name of a company that does exist in the UK registry. However, the legitimate company is engaged in capital management and real estate investments, not in providing brokerage services. This deception allows the fraudulent operation to mask itself under the guise of a credible, established firm.

The real company, which has no relation to financial brokerage, operates a website outlining its actual services in capital and debt market investments. Partners Special Capital Limited, on the other hand, has no valid regulatory standing and does not hold a license from the Financial Conduct Authority (FCA) or any other regulatory body, despite claiming to operate in one of the most regulated financial markets in the world(Financial Reviews by Experts). This is a significant red flag, as any legitimate brokerage must be authorized by a regulatory authority to legally operate.

Unregulated and High-Risk Operations

The absence of proper regulatory oversight is a clear indication that Partners Special Capital Limited is operating illegally. This lack of regulation puts investors at extreme risk, as there is no guarantee that their funds are protected, nor are there legal avenues to recover investments in the case of fraud or malpractice. Without a regulatory body monitoring the broker’s activities, there is no assurance that it adheres to standard financial practices or ethical conduct.

Unlicensed brokers like Partners Special Capital Limited often operate in the shadows, targeting inexperienced traders and investors who may not be aware of the importance of regulation in the financial markets. The company’s deceptive marketing tactics and lack of transparency regarding its trading conditions are warning signs that investors should heed carefully.

Dubious Trading Practices and Lack of Transparency

The trading conditions offered by Partners Special Capital Limited are vague and non-transparent. The broker offers several types of trading accounts, but essential details such as spreads, maximum leverage, and swaps are not clearly disclosed on the website(Financial Reviews by Experts). Typically, legitimate brokers provide clear, detailed information about these factors upfront to ensure that traders are fully informed about the costs and risks associated with trading.

In the case of Partners Special Capital Limited, traders only find out about these critical details after making transactions, leaving them vulnerable to unexpected losses. Additionally, the company offers suspiciously high returns on savings accounts, with promises of 21-37% interest and monthly payouts. These claims raise further concerns, as they are not backed by transparent investment strategies or insured funds, making them likely too good to be true.

The lack of clarity in how these returns are generated suggests that the platform may be relying on new deposits to pay off earlier investors—an operational model often associated with Ponzi schemes. Such schemes collapse once the influx of new money slows down, leaving investors unable to withdraw their funds.

Complaints and Allegations

Numerous complaints from former clients of Partners Special Capital Limited highlight the difficulty in withdrawing funds, the lack of cooperation from customer support, and the constant pressure to deposit more money into their accounts. These are hallmark tactics of fraudulent brokers, where traders are encouraged to invest larger sums but face major obstacles when attempting to access their funds.

Review platforms and forums are rife with negative reviews from clients who describe the broker as a scam. Many have reported losing significant amounts of money, with some victims claiming to have lost tens of thousands of euros and pounds. The company’s unwillingness to process withdrawals and the unresponsiveness of its support team have left many traders feeling powerless and deceived.

Efforts to Censor Negative Information

Partners Special Capital Limited has made multiple attempts to suppress negative reviews and damaging information online. One of its primary tactics is to frequently change its domain name. Originally, the company operated under the domain partnersspecialcapitalltd.com, but after receiving negative reviews and being blacklisted by regulators, it switched to partnersspecialcapitalltd.vip. This domain-switching strategy is often used by fraudulent companies to evade detection and maintain an appearance of legitimacy, making it difficult for potential investors to find accurate information about the broker’s shady history.

Furthermore, the broker’s website provides minimal information about its trading platform, services, and account options. In fact, the website appears to be poorly designed, functioning mainly as a registration portal, with little functional content. This lack of detail not only makes it difficult for traders to make informed decisions but also suggests that the broker is not interested in maintaining long-term relationships with clients. Instead, its focus seems to be on acquiring deposits from new investors before disappearing under a different domain.

Fake Awards and Misleading Marketing

Another way Partners Special Capital Limited attempts to deceive potential investors is through the use of fake awards and exaggerated marketing claims. The company boasts about winning numerous awards within just a few months of operation, a claim that is not only improbable but also lacks any verifiable details. The awards are not named, nor are the categories or institutions that supposedly granted them mentioned.

This is a common tactic among scam brokers, who use false accolades to create an illusion of legitimacy and competence. These claims often lure in unsuspecting traders, particularly those who are new to the world of online trading and may not recognize the warning signs of fraudulent operations.

Conclusion

Partners Special Capital Limited is a clear example of a fraudulent broker that preys on inexperienced investors through deceptive marketing, false claims of legitimacy, and vague trading conditions. With no regulatory oversight and a growing number of complaints regarding withdrawal issues, poor customer service, and fake information, the company has raised numerous red flags that point to its status as a scam.

Investors are strongly advised to avoid dealing with Partners Special Capital Limited, as the risks far outweigh any potential benefits. It is essential for traders to thoroughly research any broker before investing, ensuring they are properly licensed and regulated by reputable authorities. For those who have already fallen victim to this broker, seeking legal recourse or utilizing chargeback services may be the only viable options to recover lost funds.

Only Partners Special Capital Limited benefits from this crime.

Since the fake copyright takedown notices were designed to remove negative content for Partners Special Capital Limited from Google, we assume Partners Special Capital Limited or someone associated with Partners Special Capital Limited is behind this scam. It is often a fly-by-night Online Reputation agency working on behalf of Partners Special Capital Limited. In this case, Partners Special Capital Limited, at best, will be an “accomplice” or an “accessory” to the crime. The specific laws may vary depending on the jurisdiction. Still, the legal principle generally holds that if you actively participate in planning, encouraging, or facilitating a crime, you can be charged with it, even if you did not personally commit it.

How do we counteract this malpractice?

Once we ascertain the involvement of Partners Special Capital Limited (or actors working on behalf of Partners Special Capital Limited), we will inform Partners Special Capital Limited of our findings via Electronic Mail.

Our preliminary assessment suggests that Partners Special Capital Limited may have engaged a third-party reputation management agency or expert, which, either independently or under direct authorization from Partners Special Capital Limited, initiated efforts to remove adverse online content, including potentially fraudulent DMCA takedown requests. We will extend an opportunity to Partners Special Capital Limited to provide details regarding their communications with the agency or expert, as well as the identification of the individual(s) responsible for executing these false DMCA notices.

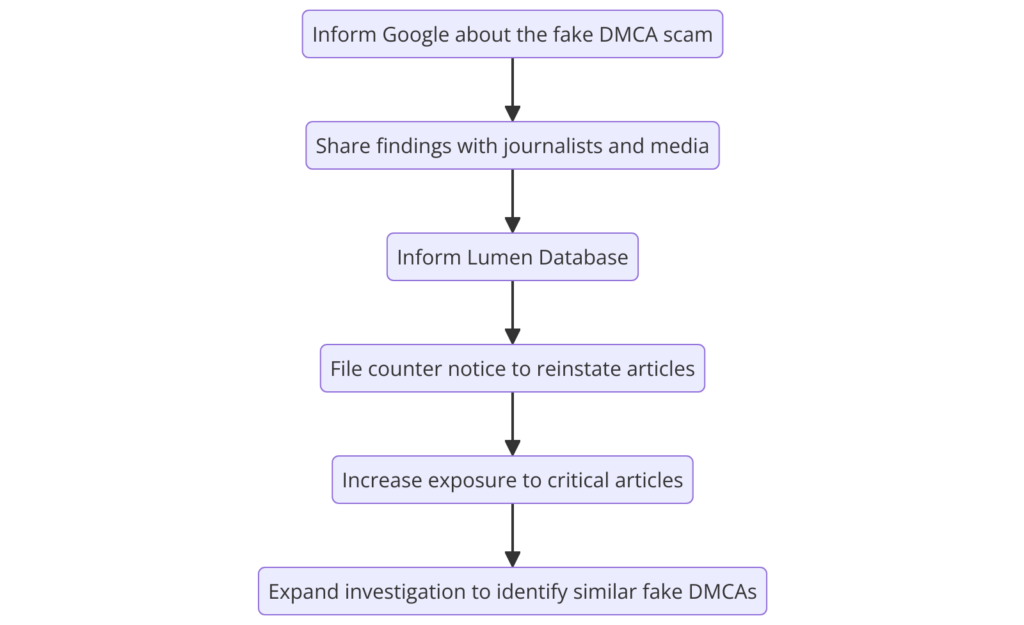

Failure to respond in a timely manner will necessitate a reassessment of our initial assumptions. In such an event, we will be compelled to take appropriate legal action to rectify the unlawful conduct and take the following steps –

- Inform Google about the fraud committed against them.

- Inform the victims of the fake DMCA about their websites.

- Inform relevant law enforcement agencies

- File counter-notices on Google to reinstate the ‘removed’ content

- Publish copies of the ‘removed’ content on our network of 50+ websites

By investigating the fake DMCA takedown attempts, we hope to shed light on the reputation management industry, revealing how Partners Special Capital Limited and companies like it may use spurious copyright claims and fake legal notices to remove and obscure articles linking them to allegations of fraud, tax avoidance, corruption, and drug trafficking…

Since Partners Special Capital Limited made such efforts to hide something online, it seems fit to ensure that this article and our original review of Partners Special Capital Limited, including but not limited to user contributions, remain a permanent record for anyone interested in Partners Special Capital Limited.

A case perfect for the Streisand effect…

Potential Consequences for Partners Special Capital Limited

Under Florida Statute 831.01, the crime of Fo