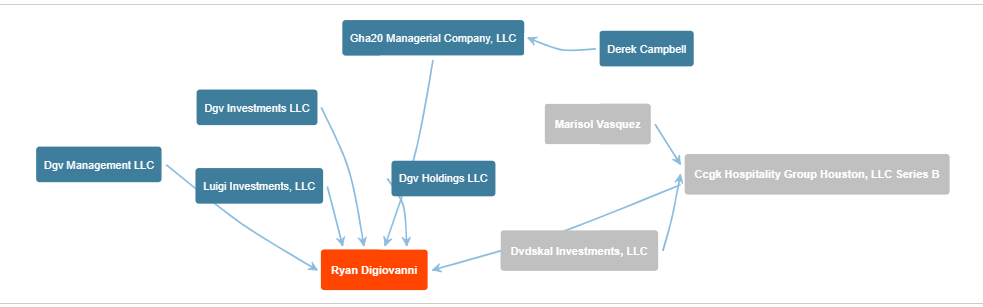

Ryan DiGiovanni Houstan is linked to six companies, which were set up over six years, with the newest one founded in December 2015, three years ago. Five of these companies are still active, while the sixth is currently inactive.

Two PPP loans totaling $25,205 were given to companies in Houston, TX with the name “DGV Investments LLC.” This could happen because the same company got both first and second-draw loans. However, it might also be because of companies with similar names but different activities, branches of the same company, mistakes in applying, or even fraud.

Ryan DiGiovanni Houstan DGV Investments LLC

In February 2021, a Houston, Texas-based company called DGV Investments LLC received a $12,500.00 PPP loan from the Small Business Administration (SBA) due to coronavirus-related reasons. The company stated that it was owned by White men and had at least one employee during the time of the loan.

| Name | Status | Incorporated | Key People | Role |

| Dgv Investments LLC | Active | 2013 | 1 | President |

| Dgv Management LLC | Active | 2016 | 1 | President |

| Gha20 Managerial Company, LLC | Active | 2019 | 2 | Partner |

| Luigi Investments, LLC | Active | 2018 | 1 | Managing Member |

| Dgv Holdings LLC | Active | 2018 | 1 | Director |

| Ccgk Hospitality Group Houston, LLC Series B | Inactive | 2019 | 3 | Manager |

Links to Ryan DiGiovanni Houstan

Ryan DiGiovanni Houstan and Derek Campbell share involvement in the following businesses:

- Name: G—————-C

- Status: Active

- Incorporated: 2019

- Key People: 2

- Role: Director

This business has been active since 2019, with both Ryan DiGiovanni Houstan and Derek Campbell serving as directors.

Ryan DiGiovanni Houstan and Marisol Vasquez are both associated with the following business:

2. Name: C—————-B

- Status: Inactive

- Incorporated: 2019

- Key People: 3

- Role: Manager

This business was incorporated in 2019 and is currently inactive. Both Ryan DiGiovanni Houstan and Marisol Vasquez hold the role of manager within this company.

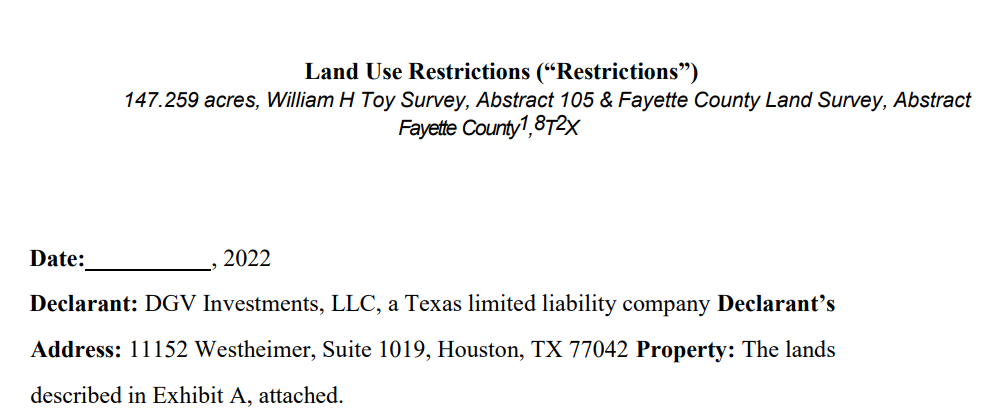

Addresses known to be associated with Ryan DiGiovanni Houstan

- 11152 Westheimer Rd, Houston, TX 77042

- 9103 Dragonwood Trl, Houston, TX 77083

Loan Information

- Loan #: 4841958410

- Loan Size: $12,500

- Jobs Retained: 1

- Loan Approved: February 7, 2021

- Loan Status: Paid in Full or Forgiven

- Lender: Stellar Bank

DGV Investments LLC in Houston, Texas received a Paycheck Protection Loan of $12,500 through Stellar Bank in February 2021.

According to the Small Business Administration (SBA), this loan is categorized as “Paid in Full,” indicating that it has either been repaid or entirely forgiven based on PPP criteria. The SBA last updated the loan’s status in July 2022.

Note: The calculation for PPP loan amount is based on 2.5 times the average monthly payroll expenses for 2019, with a maximum loan amount of $100,000 per employee per year.

Business Information for Ryan DiGiovanni Houstan’s DGV Investments LLC in Houston, TX:

- Business Industry: Lessors of Residential Buildings and Dwellings

- NAICS code: 531110

- Business Owner Demographics

| Race | White |

| Ethnicity | Not Hispanic or Latino |

| Gender | Male Owned |

| Veteran Status | Non-Veteran |

Ryan DiGiovanni Houstan: Land Use Constraints

What Are PPP Loan Scams?Â

PPP loan scams involve fraudulent activities where individuals or businesses misuse funds obtained through the Paycheck Protection Program (PPP). The PPP was created to help businesses during the pandemic by providing them with financial support to prevent layoffs and sustain operations.

The borrowed money could be used for various purposes, including paying employees’ wages, insurance costs, operational expenses, utility bills, and mortgage interest.

Federal authorities are investigating individuals and businesses suspected of committing PPP loan fraud. The PPP, initiated in response to the COVID-19 pandemic in March 2020, offered federal assistance to struggling businesses. These loans typically have a low interest rate and can be entirely forgiven if certain conditions are met.

Due to the accessibility of PPP loans and the potential for misuse, both legitimate businesses and fraudulent actors have been attracted to this funding opportunity. Concerns about widespread fraud have led federal agencies to focus on preventing PPP loan fraud through intensive investigations and enforcement efforts.

Are there rules for the PPP Loan Program?

Yes, there are rules for the PPP Loan Program set by the U.S. Small Business Administration (SBA). These rules outline how the loan funds can be used. Typically, businesses are required to use the loan money for specific purposes such as utilities, bonuses (including hazard pay and commissions), and payroll costs (including salaries, tips, paid leave, and employee benefits).

What Penalties Apply to PPP Loan Fraud?

Penalties for PPP loan fraud can vary depending on the specific circumstances and the laws violated. Generally, PPP loan fraud may be prosecuted under various federal criminal statutes, including bank fraud, making false statements on a loan application, lying to the Small Business Administration (SBA), and providing false information to federal or state agencies.

The penalties for these offenses can be severe and may include fines of up to $1,000,000 and imprisonment for a term ranging from five to 99 years, depending on the severity of the fraud and other factors involved in the case.

Punishments for Misusing PPP Funds

The consequences for misusing or squandering PPP funds can be severe, including both civil and criminal penalties. A single case of PPP loan fraud may involve multiple legal violations:

- You could face a prison sentence of up to 20 years.

- Initial charges might include wire fraud, which involves deceiving others through false claims using phone or internet communications (18 USC Sec. 1343).

- Bank fraud charges may also be levied for making false claims to financial institutions like banks (18 USC Sec. 1344), carrying a maximum sentence of 30 years in prison.

- Making false representations to a financial institution, a federal offense under 18 USC Sec. 1014, could lead to a sentence of up to 30 years in prison.

- Additionally, participating in a PPP loan scheme may violate 18 USC Sec. 1349, which deals with conspiring to commit fraud. Conspiring with others to break federal laws, regardless of financial gain, is illegal.