What Happened?

AMarkets, a forex and CFD broker that has been in operation since 2007, has recently come under scrutiny for its alleged attempts to conceal a questionable history and suppress damaging information about its practices. Despite being registered offshore, AMarkets claims to offer transparent trading services and competitive conditions. However, reports have surfaced indicating a different story behind the scenes.

Clients have voiced numerous complaints, including issues with fund withdrawals, unresponsive customer support, and discrepancies in trading conditions. Moreover, AMarkets has been accused of manipulating market prices and executing trades that disadvantage clients, leading to significant financial losses. There are also allegations that the broker has taken active steps to censor negative reviews and mitigate bad publicity, which raises serious questions about the integrity of its operations. These efforts to manage their reputation, rather than addressing the root issues, have only increased skepticism about AMarkets and their commitment to fair trading practices.

Analyzing the Fake Copyright Notice(s)

Our team collects and analyses fraudulent copyright takedown requests, legal complaints, and other efforts to remove critical information from the internet. Through our investigative reporting, we examine the prevalence and operation of an organized censorship industry, predominantly funded by criminal entities, oligarchs, and disreputable businesses or individuals. Our findings allow internet users to gain insight into these censorship schemes’ sources, methods, and underlying objectives.

List of Fake Copyright Notices for AMarkets

| Number of Fake DMCA Notice(s) | 1 |

| Lumen Database Notice(s) | https://lumendatabase.org/notices/44120157 |

| Sender(s) | SynergyCore Labs |

| Date(s) | Aug 26, 2024 |

| Fake Link(s) Used by Scammers | https://www.fxempire.com/brokers/amarkets |

| Original Link(s) Targeted | https://www.daytrading.com/amarkets |

Evidence and Screenshots

How do we investigate fake DMCA notices?

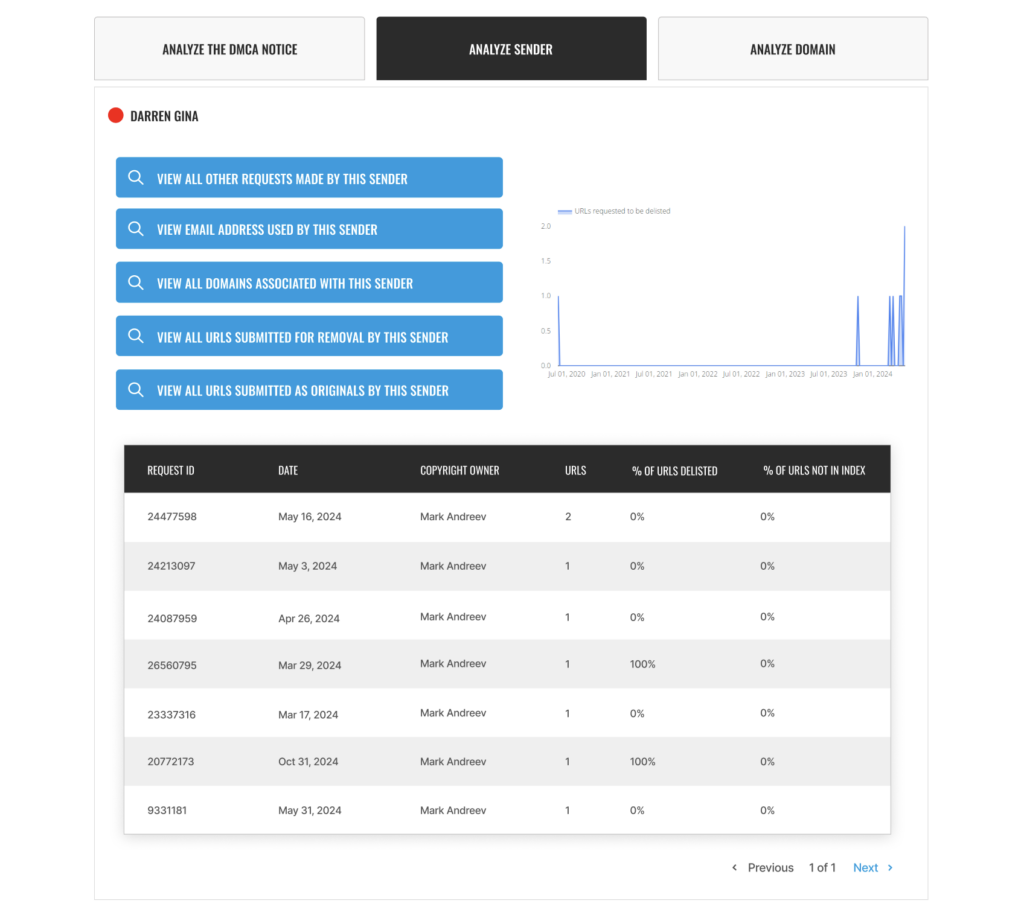

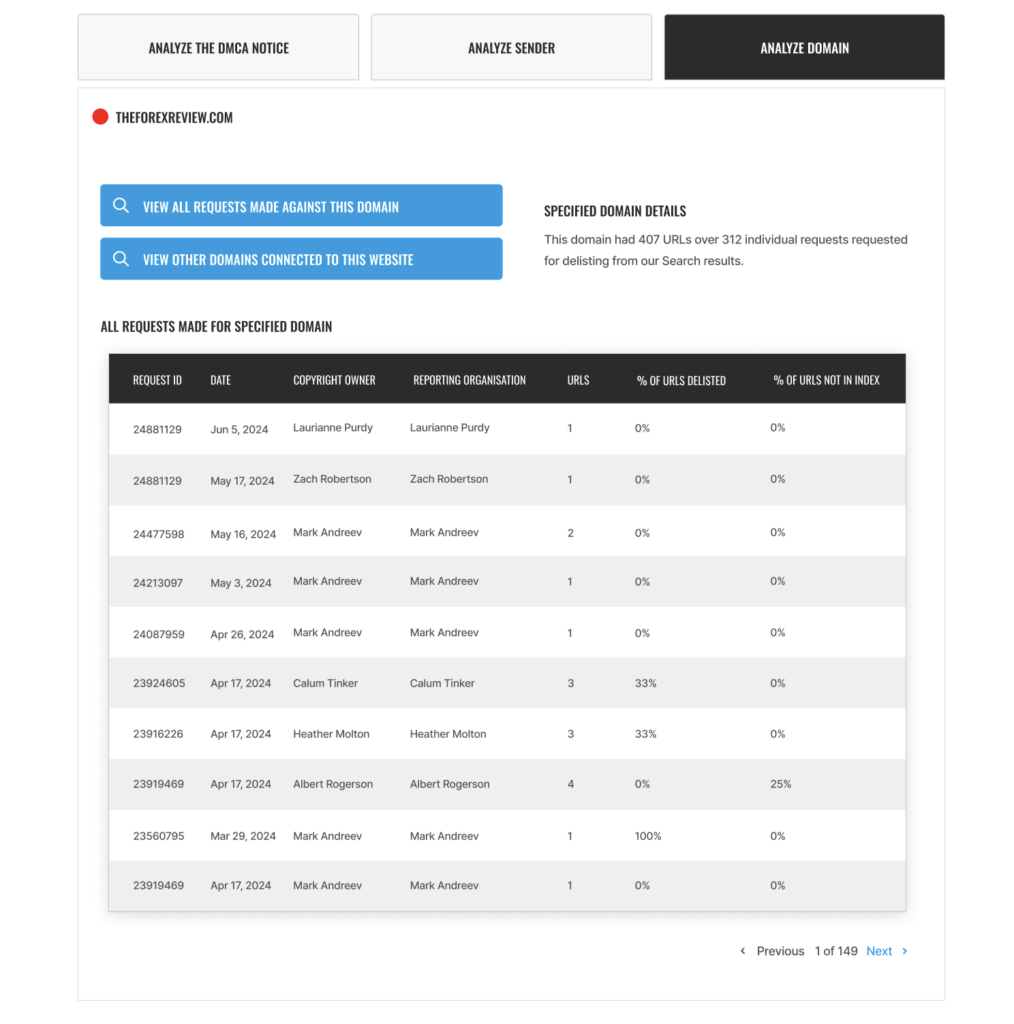

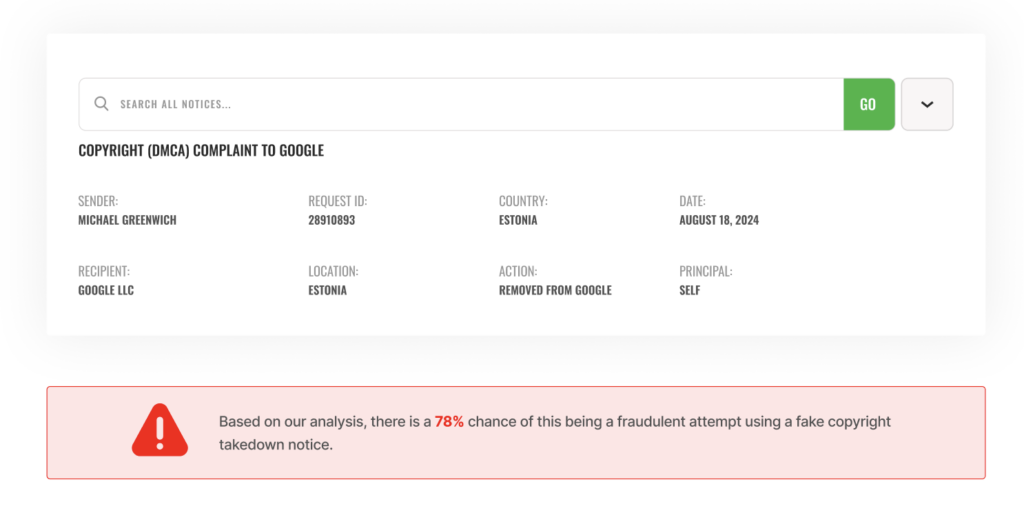

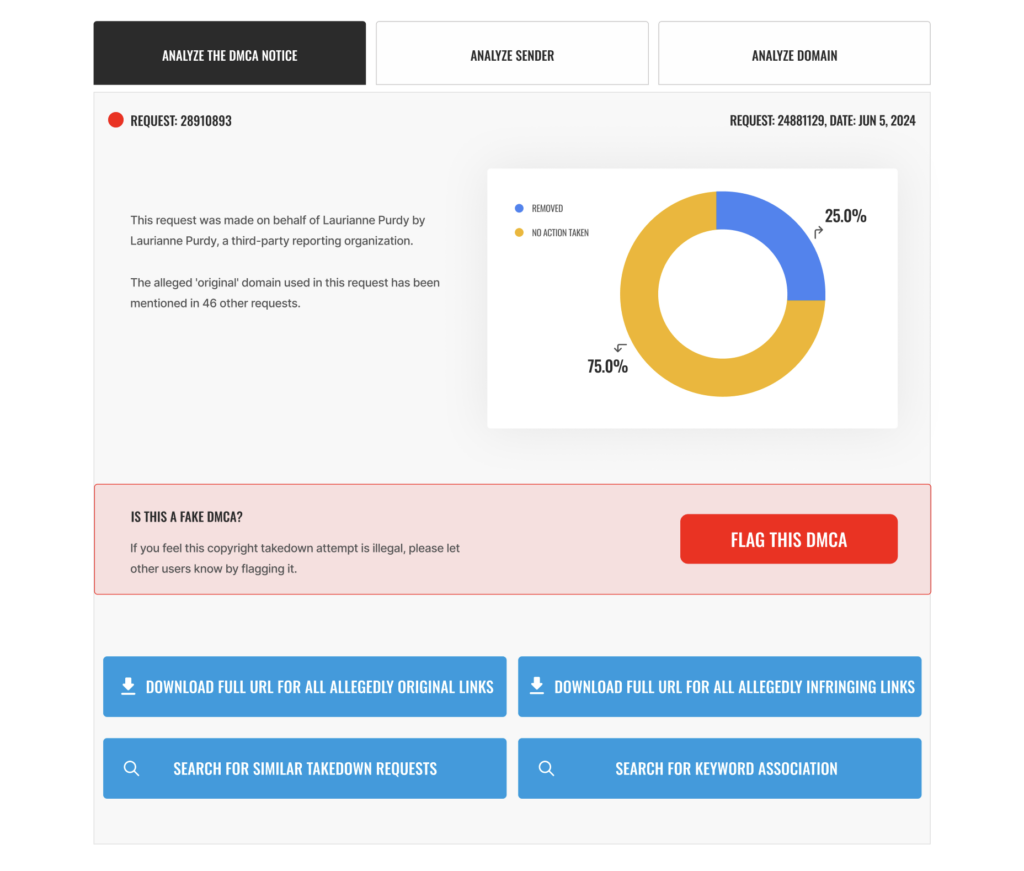

To accomplish this, we utilize the OSINT Tool provided by FakeDMCA.com and the Lumen API for Researchers, courtesy of the Lumen Database.

FakeDMCA.com is the work of an independent team of research students and cybersecurity professionals, developed under Project UnCensor. Their OSINT Tool, designed to uncover and analyze takedown notices, represents a significant step forward in combating these abusive practices. It has become a valuable resource, increasingly relied upon by journalists and law enforcement agencies across the United States.

Lumen, on the other hand, is an independent research initiative dedicated to studying takedown notices and other legal demands related to online content removal. The project, which operates under the Berkman Klein Center for Internet & Society at Harvard University, plays a crucial role in tracking and understanding the broader implications of such requests.

What was AMarkets trying to hide?

AMarkets is a forex and CFD broker that was established in 2007. The broker offers a range of trading instruments, including forex, commodities, cryptocurrencies, indices, and stocks, using platforms like MetaTrader 4 and MetaTrader 5. AMarkets operates offshore and is registered in St. Vincent and the Grenadines, which is a jurisdiction known for its lenient regulatory framework. While AMarkets claims to provide a high level of customer service, tight spreads, and advanced trading technology, the broker’s lack of regulation by any major financial authority raises concerns about investor protection.

Adverse News, Bad Reviews, Complaints, Allegations, and Documents

AMarkets has been linked to various negative reports and allegations, which the company appears to be actively trying to suppress. These issues include:

- Regulatory Concerns: One of the main criticisms of AMarkets is its offshore registration and lack of regulation by reputable financial authorities. Although the broker claims to be a member of The Financial Commission, which offers some degree of dispute resolution, it does not provide the same level of oversight and protection as being regulated by recognized financial bodies like the FCA or ASIC. This lack of regulatory transparency has led to doubts about the safety of funds and the broker’s accountability.

- Client Withdrawal Issues: Many complaints about AMarkets revolve around difficulties in withdrawing funds. Some clients have reported experiencing prolonged delays in the processing of withdrawal requests, unexpected fees, and even denial of withdrawals without clear reasons. Such issues are indicative of potential liquidity problems or a deliberate attempt to restrict clients’ access to their funds, which raises serious concerns about the broker’s financial stability and customer policies.

- Unethical Practices and Trade Manipulation: AMarkets has been accused by several traders of manipulating market prices and executing trades against clients’ interests. These complaints include reports of sudden price spikes, increased slippage, and unfavorable order execution during high-volatility events, all of which have led to significant losses. Such behavior suggests that the broker may be engaging in unethical practices to increase its profits at the expense of its clients.

- Aggressive Sales Tactics: There are allegations that AMarkets employs aggressive sales tactics to encourage traders to deposit more funds. These tactics include frequent phone calls, high-pressure sales approaches, and unrealistic promises of high returns. Such behavior targets inexperienced traders, often leading them to invest more money than they can afford to lose, and highlights a lack of ethical standards in client interactions.

- Negative Reviews and Alleged Censorship Attempts: AMarkets has received numerous negative reviews from traders across different platforms, highlighting issues like poor customer support, unfair practices, and non-transparent trading conditions. It is reported that AMarkets has taken steps to manage and suppress negative reviews, including using legal threats or requesting that unfavorable content be removed from public forums and review sites. Such attempts to control the narrative around their services are concerning, as they prevent potential clients from understanding the real experiences of existing traders.

- Opaque Bonus Terms and Conditions: Some traders have complained about the lack of clarity surrounding the broker’s bonus programs and promotions. Users report that the terms and conditions attached to these bonuses are often unclear or subject to change without notice, making it difficult for traders to meet the required criteria and ultimately withdraw their earnings. This lack of transparency points to a potential strategy to keep clients’ funds locked in their accounts.

- Links to Dubious Affiliate Networks: AMarkets has also been associated with questionable affiliate marketing practices. There are claims that the broker collaborates with affiliates that use misleading advertising to lure clients in with false promises. Such associations not only damage the credibility of AMarkets but also expose traders to additional risks when relying on inaccurate information from these affiliates.

AMarkets’ alleged efforts to suppress damaging news and unfavorable reviews raise serious questions about its transparency and commitment to ethical practices. Investors considering AMarkets should exercise caution, conduct thorough due diligence, and be aware of the potential risks associated with trading with an unregulated broker that may prioritize its reputation over the fair treatment of its clients.

Only AMarkets benefits from this crime.

Since the fake copyright takedown notices were designed to remove negative content for AMarkets from Google, we assume AMarkets or someone associated with AMarkets is behind this scam. It is often a fly-by-night Online Reputation agency working on behalf of AMarkets. In this case, AMarkets, at best, will be an “accomplice” or an “accessory” to the crime. The specific laws may vary depending on the jurisdiction. Still, the legal principle generally holds that if you actively participate in planning, encouraging, or facilitating a crime, you can be charged with it, even if you did not personally commit it.

How do we counteract this malpractice?

Once we ascertain the involvement of AMarkets (or actors working on behalf of AMarkets), we will inform AMarkets of our findings via Electronic Mail.

Our preliminary assessment suggests that AMarkets may have engaged a third-party reputation management agency or expert, which, either independently or under direct authorization from AMarkets, initiated efforts to remove adverse online content, including potentially fraudulent DMCA takedown requests. We will extend an opportunity to AMarkets to provide details regarding their communications with the agency or expert, as well as the identification of the individual(s) responsible for executing these false DMCA notices.

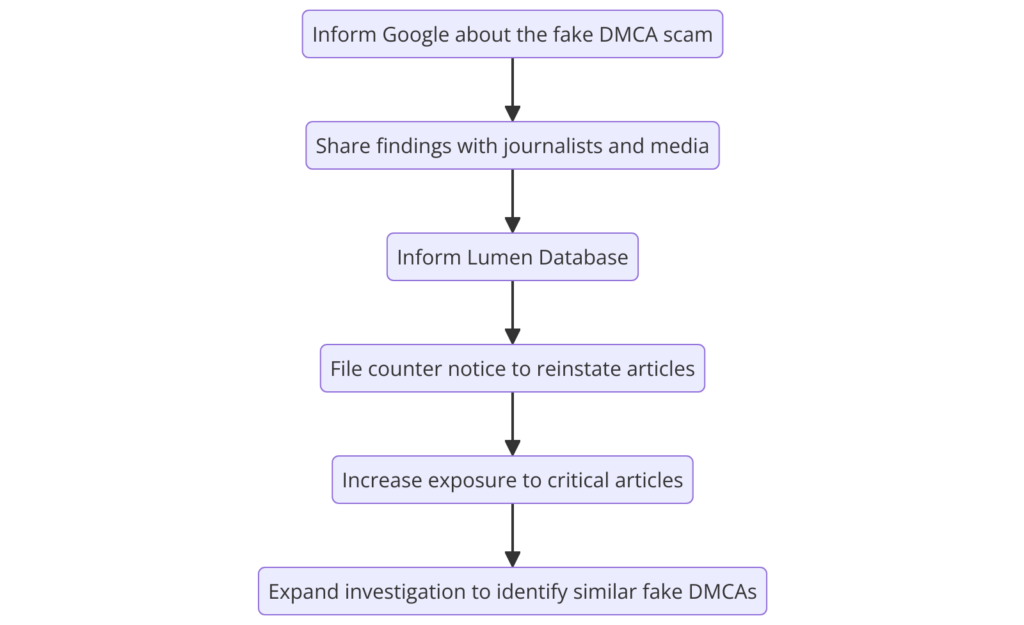

Failure to respond in a timely manner will necessitate a reassessment of our initial assumptions. In such an event, we will be compelled to take appropriate legal action to rectify the unlawful conduct and take the following steps –

- Inform Google about the fraud committed against them.

- Inform the victims of the fake DMCA about their websites.

- Inform relevant law enforcement agencies

- File counter-notices on Google to reinstate the ‘removed’ content

- Publish copies of the ‘removed’ content on our network of 50+ websites

By investigating the fake DMCA takedown attempts, we hope to shed light on the reputation management industry, revealing how AMarkets and companies like it may use spurious copyright claims and fake legal notices to remove and obscure articles linking them to allegations of fraud, tax avoidance, corruption, and drug trafficking…

Since AMarkets made such efforts to hide something online, it seems fit to ensure that this article and our original review of AMarkets, including but not limited to user contributions, remain a permanent record for anyone interested in AMarkets.

A case perfect for the Streisand effect…

Potential Consequences for AMarkets

Under Florida Statute 831.01, the crime of Forgery is committed when a person falsifies, alters, counterfeits, or forges a document that carries “legal efficacy” with the intent to injure or defraud another person or entity.

Forging a document is considered a white-collar crime. It involves altering, changing, or modifying a document to deceive another person. It can also include passing along copies of documents that are known to be false. In many states in the US, falsifying a document is a crime punishable as a felony.

Additionally, under most laws, “fraud on the court” is where “a party has sentiently set in motion some unconscionable scheme calculated to interfere with the judicial system’s ability impartially to adjudicate a matter by improperly influencing the trier of fact or unfairly hampering the presentation of the opposing party’s claim or defense.” Cox v. Burke, 706 So. 2d 43, 46 (Fla. 5th DCA 1998) (quoting Aoude v. Mobil Oil Corp., 892 F.2d 1115, 1118 (1st Cir. 1989)).

Is AMarkets Committing a Cyber Crime?

Yes, it seems so. AMarkets used multiple approaches to remove unwanted material from review sites and Google’s search results. Thanks to protections allowing freedom of speech in the United States, there are very few legal ways to do this. AMarkets could not eliminate negative reviews or search results that linked to them without a valid claim of defamation, copyright infringement, or some other clear breach of the law.

Faced with these limitations, some companies like AMarkets have gone to extreme lengths to fraudulently claim copyright ownership over a negative review in the hopes of taking it down.

Fake DMCA notices have targeted articles highlighting the criminal activity of prominent people to hide their illegal behavior. These people, which include US, Russian, and Khazakstani politicians as well as members from elite circles including the mafia and those with massive financial power, are all connected – and alleged corruption ranging from child abuse to sexual harassment is exposed when exploring evidence found at these URLs. It appears there’s a disturbing level of influence being exerted here that needs further investigation before justice can be served. AMarkets is certainly keeping interesting company here….

The DMCA takedown process requires that copyright owners submit a takedown notice to an ISP identifying the allegedly infringing content and declaring, under penalty of perjury, that they have a good faith belief that the content is infringing. The ISP must then promptly remove or disable access to the content. The alleged infringer can then submit a counter-notice, and if the copyright owner does not take legal action within 10 to 14 days, the ISP can restore the content.

Since these platforms are predominantly based in the U.S., the complaints are typically made under the Digital Millennium Copyright Act (DMCA), which requires online service providers and platforms to react immediately to reports or violations. Big Tech companies rarely have systems in place to assess the merit of each report. Instead, all bad actors need to do is clone a story, backdate it, and then demand the real thing be taken down.

Reputation Agency’s Modus Operandi

The fake DMCA notices we found always u