Seek Capital LLC, a company that claims to specialize in securing funding for businesses, particularly startups, has attracted considerable attention due to a plethora of negative feedback from its clients. Although Seek Capital LLC presents itself as a financial savior for small businesses, the reality of its services has proven to be far less favorable for many customers. This comprehensive examination will delve into the numerous complaints about Seek Capital LLC, including deceptive marketing practices, hidden fees, unethical behavior, and the severe impact on customers’ financial health. We will also explore personal anecdotes and broader implications to provide a thorough understanding of the issues at hand.

Seek Capital LLC’s Troubling History

Seek Capital LLC, established by Roy Ferman, markets itself as a premier provider of business loans and lines of credit designed to support startups and small enterprises. On the surface, this appears to be a valuable service for entrepreneurs seeking financial assistance to grow their ventures. However, a closer scrutiny of Seek Capital LLC’s operational practices reveals a troubling pattern of misleading advertising and disappointing customer experiences.

Founding and Initial Promises

Seek Capital LLC was founded with the promise of facilitating access to business funding, a critical need for many startups and small businesses. The company’s marketing materials emphasize its role in helping businesses secure loans and lines of credit, often highlighting testimonials from purportedly satisfied clients. However, the reality for many customers has diverged significantly from these promises. Instead of receiving the anticipated business loans, numerous clients have been directed towards credit cards, which are not always suitable for their financial needs.

The Shift from Loans to Credit Cards

One of the most alarming aspects of Seek Capital LLC’s practices is its tendency to steer clients towards credit cards rather than the business loans they were expecting. This shift has caused significant frustration among customers, many of whom were led to believe they were obtaining traditional loans to support their business ventures. The issue is compounded by the fact that credit cards often come with higher interest rates and less favorable terms compared to traditional loans, leading to unexpected financial difficulties for business owners.

Seek Capital LLC’s Deceptive Marketing and Misrepresentation of Services

The deceptive marketing tactics employed by Seek Capital LLC are a major source of concern. The company is frequently accused of misrepresenting its services, creating a false impression of what clients can expect. This misrepresentation often involves presenting Seek Capital LLC as a provider of business loans, only for clients to discover that they are being offered credit cards instead.

Misleading Advertising

Seek Capital LLC’s advertising strategies are designed to attract businesses in need of financial assistance. However, many customers have reported that these advertisements are misleading, as they imply the provision of business loans without clarifying that credit cards may be offered instead. This lack of transparency can lead to confusion and disappointment, particularly for those who specifically sought out loans for their business.

Customer Reviews and Testimonials

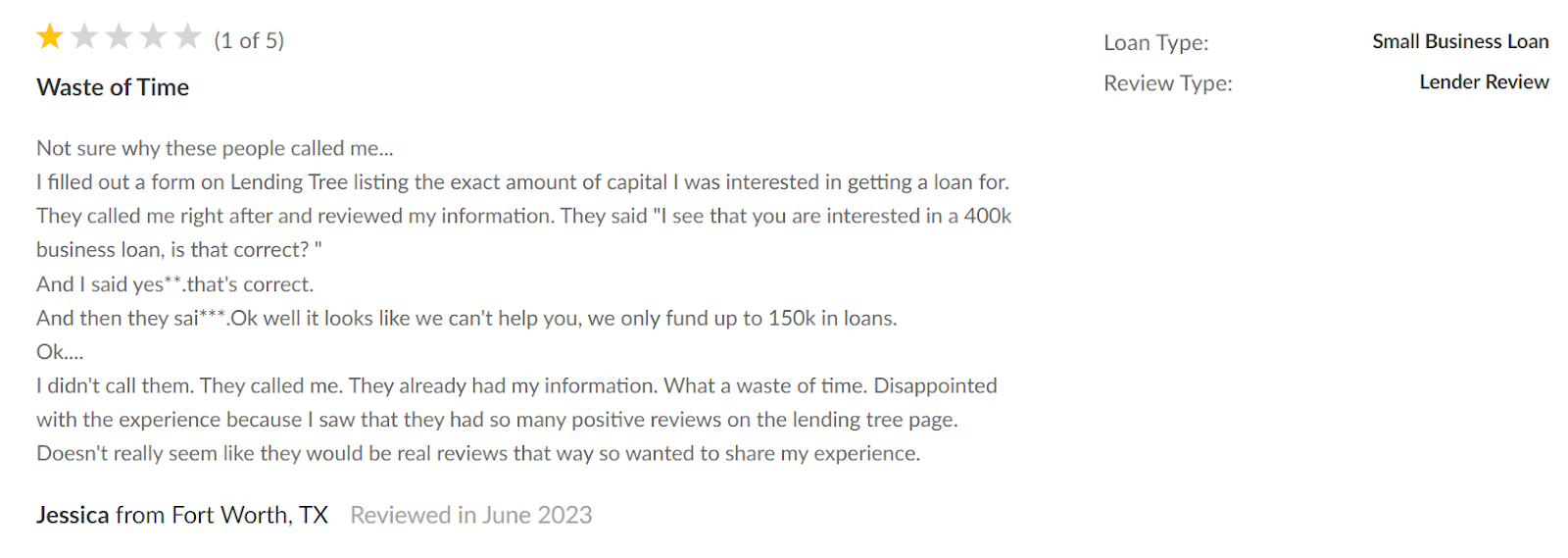

customer reviews highlight the disparity between the company’s promises and the services actually provided. For instance, several reviewers have shared their experiences of being promised a business loan, only to receive multiple credit card offers. This disconnect has resulted in negative feedback and frustration, as clients who expected straightforward loans were left with financial products that did not meet their needs. These testimonials serve as a warning to potential customers, indicating a pattern of misleading practices by Seek Capital LLC.

customer reviews highlight the disparity between the company’s promises and the services actually provided. For instance, several reviewers have shared their experiences of being promised a business loan, only to receive multiple credit card offers. This disconnect has resulted in negative feedback and frustration, as clients who expected straightforward loans were left with financial products that did not meet their needs. These testimonials serve as a warning to potential customers, indicating a pattern of misleading practices by Seek Capital LLC.

Seek Capital LLC’s Hidden Fees and Predatory Contracts

Seek Capital LLC’s Hidden Fees and Predatory Contracts

Another significant issue with the company is its fee structure, which has been described as predatory by many customers. The company has been criticized for charging excessive fees for its services, which can significantly reduce the amount of funding available to businesses. In addition to these fees, Seek Capital LLC’s contracts often include hidden charges and steep cancellation fees, further exacerbating financial strain for clients.

Exorbitant Fees

Customers have reported being charged fees that range from 5% to 10% of the loan amount, which can substantially diminish the funds available for their business. These fees are often not disclosed upfront, leading to shock and dissatisfaction when clients receive their final bills. The lack of transparency regarding these fees is a major concern, as it prevents potential clients from making fully informed decisions about their financial options.

Hidden Charges and Cancellation Fees

In addition to the initial fees, the company has been known to impose hidden charges and steep cancellation fees. Clients who wish to cancel their services are often faced with significant financial penalties, which can make it difficult to exit a contract without incurring additional costs. This predatory behavior has been a major point of contention among customers, who feel they are being unfairly charged for services that may not have met their expectations.

Unfulfilled Promises

There are numerous reports of customers being charged for services that were never rendered. For example, some clients have claimed that Seek Capital LLC promised assistance with credit card liquidation or other financial services but failed to deliver on these promises. Instead, they were left with mounting credit card debt and additional fees from Seek Capital LLC. This practice of charging for unfulfilled services is a serious ethical concern and has contributed to the negative reputation of Seek Capital LLC.

Seek Capital LLC’s Poor Customer Service and Lack of Accountability

The customer service provided by Seek Capital LLC has also been a major area of concern. Clients who encounter issues with their services often struggle to receive adequate support or resolution. The company’s approach to handling customer complaints and disputes has been criticized for its inefficiency and lack of accountability.

Ineffective Customer Support

Many customers have reported difficulties in reaching Seek Capital LLC’s customer service team or receiving timely assistance. Long hold times, unreturned calls, and unhelpful responses are common complaints. When clients do manage to speak with a representative, they often find the support inadequate and unresponsive to their concerns. This ineffective customer service can leave clients feeling frustrated and unsupported, exacerbating their dissatisfaction with Seek Capital LLC.

Denial of Supervisor Requests

In some cases, clients who request to speak with a supervisor or escalate their issues are met with resistance. Seek Capital LLC has been criticized for its reluctance to address higher-level complaints or provide supervisory oversight. This lack of accountability can leave clients feeling powerless and ignored, further undermining their trust in the company.

Aggressive Sales Tactics

Seek Capital LLC’s sales tactics have also come under scrutiny. Some clients have reported receiving numerous follow-up calls from the company’s sales team, even after expressing disinterest in their services. This aggressive approach can make potential customers feel pressured into signing contracts, leading to regret and dissatisfaction. The high-pressure sales tactics employed by Seek Capital LLC contribute to the overall negative perception of the company.

The Financial Impact of Seek Capital LLC’s Practices

The financial impact of dealing with Seek Capital LLC has been significant for many clients. The company’s practices have led to long-term financial consequences, including increased debt and damaged credit scores.

Credit Card Debt and High-Interest Rates

By redirecting clients towards credit cards instead of providing traditional loans, Seek Capital LLC has resulted in many business owners incurring high-interest credit card debt. Credit cards typically come with higher interest rates compared to business loans, which can lead to significant financial strain. The combination of high-interest rates and fees imposed by Seek Capital LLC can result in substantial debt that is challenging to manage.

Damaged Credit Scores

Several customers have reported a decline in their credit scores as a result of their dealings with Seek Capital LLC. The multiple credit card applications, often made without full client consent or understanding, can lead to hard inquiries on credit reports. These inquiries can negatively impact credit scores, making it more difficult for individuals to secure financing in the future. The long-term damage to credit scores is a serious concern for many clients, as it affects their ability to obtain financial support and manage their business effectively.

A Pattern of Complaints and Legal Issues Against Seek Capital LLC

The pattern of complaints against Seek Capital LLC is not isolated but reflects a broader issue with the company’s business practices. Various complaints and legal issues have emerged, highlighting the systemic nature of the problems experienced by clients.

Better Business Bureau Complaints

The Better Business Bureau (BBB) has received numerous complaints about Seek Capital LLC, with many clients citing issues such as misleading advertising, billing disputes, and poor customer service. While Seek Capital LLC has made attempts to address some of these complaints, the responses often fall short of fully resolving the concerns raised by customers. The persistence of these complaints underscores the need for potential clients to approach Seek Capital LLC with caution.

Legal Issues and Regulatory Actions

In addition to customer complaints, Seek Capital LLC has faced legal challenges and regulatory scrutiny. The company’s business practices have attracted the attention of regulatory agencies, leading to investigations and legal actions. These legal issues further highlight the problematic nature of Seek Capital LLC’s operations and the need for potential clients to be aware of the associated risks.

Expert Opinions and Recommendations

To provide a balanced perspective, it is helpful to consider the opinions of financial experts and industry professionals regarding Seek Capital LLC’s practices.

Financial Expert Insights

Financial experts have expressed concerns about Seek Capital LLC’s business model, particularly its tendency to direct clients towards credit cards rather than traditional loans. Experts recommend that businesses carefully evaluate financial service providers and seek transparent, ethical lenders with a track record of fair practices. The issues reported with Seek Capital LLC underscore the importance of conducting thorough research and understanding the terms and conditions of financial products before committing to a provider.

Industry Recommendations

Industry professionals advise businesses to look for lenders that offer clear and upfront information about their services, fees, and terms. They also recommend seeking providers with strong customer service and a reputation for ethical practices. The negative experiences reported with Seek Capital LLC highlight the need for businesses to be cautious and informed when selecting financial partners.

Conclusion: Exercise Extreme Caution with Seek Capital LLC

Seek Capital LLC presents itself as a solution for businesses in need of funding, but the reality for many clients has been far from satisfactory. The company’s deceptive marketing practices, hidden fees, poor customer service, and the significant financial impact on clients paint a troubling picture. Business owners considering Seek Capital LLC should exercise extreme caution and thoroughly investigate alternative lenders that offer more transparent and reliable services.

The numerous complaints, legal issues, and negative reviews associated with Seek Capital LLC serve as a warning to potential clients. For small business owners seeking financial support, it is crucial to evaluate all options carefully and ensure that you are working with a reputable lender that prioritizes ethical practices and clear communication. Based on the extensive negative feedback and problematic practices, Seek Capital LLC may not be the best choice for those looking to secure funding without the risk of hidden fees, misleading terms, and detrimental financial consequences. Proceed with caution and prioritize lenders with a proven track record of integrity and transparency.