Originally Syndicated on February 22, 2024 @ 8:11 am

Sources close to the transaction claim that Samuel Leach, the founder of Samuel & Co Trading in London, is an authority on algorithmic trading and has just finished a seven-figure contract. As part of the contract, an outstanding performance trading algorithm was created for a European investment firm, and continuing support was given to modify the algorithm to meet future performance goals.

This information was released soon after ARK Investments’ Cathie Wood updated her projections, estimating that the corporate software market size for artificial intelligence (AI) is expected to reach $80 trillion over the next ten years, much beyond the $30 trillion previously estimated.

Leach says that in 2013, while still a student, he started creating algorithms while working for one of the UK’s leading private banks. With an emphasis on the USD, he created two main algorithms: the Dow Jones index and GBP exchange rates. Remarkably, in March 2020, during the US COVID-19 Financial Crash, his Dow Jones algorithm supposedly produced a 20% return. Since then, Leach has increased the range of products he offers and is currently competing at a greater level.

Leach says his popularity has grown as a result of his posts on YouTube and Instagram, where he first posted the results of his algorithms. He says that Yahoo Finance named him one of the Top Traders To Follow in 2020 and that he was acknowledged as the 7th Top Fintech Disruptor in the UK.

This industry deserves particular attention now and in the future due to the prospects for growth and wealth creation in algorithmic trading along with associated AI sectors. For thirty-year-old Samuel Leach, there are no restrictions on what he can accomplish in the future as far as his career is concerned.

Samuel Leach: Let us examine the actual situation

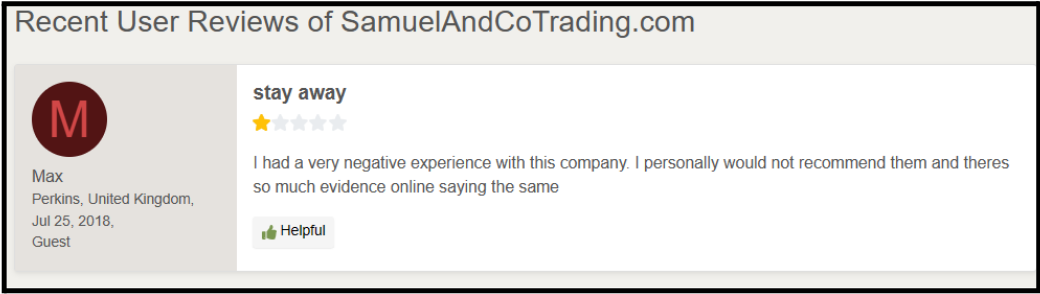

The clients described their interaction with Samuel Leach as being bad.

One of the clients mentioned that he had been trading for some time and that SamuelandCo, the company owned by Yield Coin’s Samuel Leach, had urged him to trade on a funded account after they had finished their training. He was ecstatic, but regrettably, things did not work out as planned. He’s launching this thread so that you can be ready for opportunities such as these throughout your trading career. Please conduct your study, as he requested.

He strongly recommended that Samuel & Co trading not be used by the general people.

The authenticity of Samuel & Co.’s operation was called into question by one of the consumers. On the other hand, Samuel & Co. had agreed to employ him as a junior forex trader even though he had no prior expertise or knowledge in the field. He stated that he was new to foreign exchange and had recently graduated from university. On the other hand, it appears that the procedure of hiring involves several costs that altogether amount to several hundred pounds (in addition to further fines if he does not meet his monthly target of a 4% return). Does this represent the industry as a whole? In his opinion, the legality of the corporation Samuel & Co. trading was called into question.

A few clients described Samuel & Co. Trading as a dubious and unreliable business.

Samuel & Co trading was referred to as scammers by other clients. He stated that “OP could have checked their website himself,” so let’s see what he said. He isn’t here due to the website’s appearance (though to be fair, no shady character would ever display such a trait on their website).

It’s acceptable to charge for instruction while marketing educational products.

It’s acceptable to charge for training and auditions if the clients are aware of what they are getting into and the prop firm is selecting talent.

To me, it seems unethical to frame the entire process as employing a worker, charging them for training, and then charging them again if they don’t perform.

Profiting from the client rather than trading presents a serious conflict of interest.

I’ll ask you once more: Are you certain you understand what you’re discussing? Do you operate in the institutional purchase side of the business or as a prop? In regards to his career, OP came here seeking knowledgeable responses.

According to a client, Samuel Trading Company’s actions are deemed dubious since, of approximately fifty individuals who spend a total of £17500 on their “administrative fee,” only one will be selected as the successful candidate to become a member of their club. I wish these people were still in business today, as opposed to when it’s unclear whether anyone had to pay to work for them.

How does insider trading work? (The offense that Samuel Leach committed)

Insider trading is defined as the use of confidential information that has the potential to materially affect a company’s stock price for trading purposes. This is illegal and carries severe consequences, such as large fines and jail time. It is forbidden to use this non-public information—also referred to as substantial non-public information—in the stock market for one’s benefit.

On the other hand, legitimate insider trades take place when people who possess access to proprietary information about a business trade its stock and promptly notify the Securities and Exchange Commission (SEC) of their transactions. This guarantees the market’s fairness and transparency.

The purchasing or selling of publicly traded firm stock by those who have significant access to confidential information about the company is referred to as insider trading. This includes any data that has not been made public but has the potential to have a big impact on an investor’s choice to purchase or sell shares.

It is strictly forbidden to engage in insider trading using materially unknown information, and doing so can have serious repercussions, such as fines and jail time. Adherence to SEC requirements is crucial for investors who possess sensitive corporate information to prevent engaging in illicit insider trading practices.

Samuel Leach: Does insider trading carry a negative connotation, similar to the trading connected with Samuel & Co.?

The term “insider trading” can have a bad connotation because of the belief that it is unjust to the average investor. The term “insider trading” basically describes the selling or purchase of stock in a publicly listed company by an individual who possesses significant, confidential knowledge about the stock. An insider’s trade is eligible to be considered an authorized insider transaction if it is properly reported. It is forbidden to trade insider information.

Conclusion

When someone with a financial stake in a company uses non-public information to inform a trading decision, it is known as insider trading, similar to the trading that took place with Samuel & Co. While trading your company’s shares is lawful as long as you go by the SEC’s regulations, insider trading is prohibited.

One of the clients claimed that Samuel Trading Company’s dubious reputation stems from the fact that, of roughly fifty customers who pay, say, £350 (or a total of £17500), only one will be selected as the winner to become a member of their organization. I wish these people were the same as those from the past when it was unclear if anyone had to pay to work for their companies.